BLOG

Make Your State & Federal Income Tax Payments Online!

Did you know that you have the option to make your state and federal income tax payments online?...

Self-Employed Schedule C: Get your PPP Money, NOW!

Are you a self-employed individual and a Schedule C filer? Have you received your PPP funds yet?...

Farmers & Ranchers: Get your PPP Money, NOW!

Are you a Farmer or a Rancher? Have you received your PPP funds yet? If you haven't, then listen...

Now Accepting eSignatures!

Now Accepting eSignatures! As of January 2021, Senter CPA is now allowing our clients to sign...

QuickBooks Online: Applying Payments to Invoices

Having issues applying payments to invoices? For any business owner, receiving payment for our...

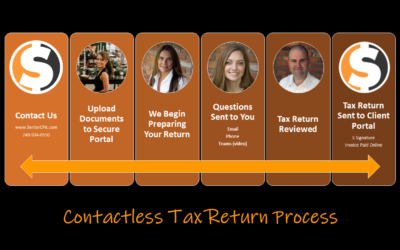

Contactless Tax Returns? Yep, We Do Those Too!

Are you wondering how you can get your tax returns done properly and efficiently, while paying as...

Why Hiring Senter, CPA is Worth the Expense

Where is the Value when hiring Senter, CPA? Often, we get phone calls and questions online asking...

Welcome to the Senter, CPA Team – Cassandra L. Senter

Hello! My name is Cassie Senter, Matt’s wife. You have probably heard Matt mention me from time to...

2020 Senter CPA Year in Review

What a Year It Has Been!This year has, without a doubt, been a year of unfathomable challenges for...

Welcome to the Senter, CPA Team – Robin R. Scrace

Some of my hobbies include: • Spending time with family & friends • Watching the...

COVID-19 Update: A look at Senter CPA’s Policies & Procedures for the 2021 Tax Season

To our wonderful Clients, Friends, and Family, Tax season is upon us! Please take a moment to...

Client Accounting Service Packages

We are proudly introducing Senter CPA's clear and concise client accounting service (CAS)...

Wreaths Across America

In honor of Veteran’s Day on November 11th, we would like to highlight Wreaths Across America, an...

Senter CPA: Year End Checklist for Businesses & Individuals

As 2020 draws to a close, it's a great time to review your business and personal finance end of...

Hiring: Office Manager (Hired 11/16/20)

OUR FIRM We are a full-service CPA firm providing tax, accounting and consulting services in...

Charitable Deductions: Maximize Your Tax Deduction

We always like to say "Don't be charitable ONLY for the tax deduction." However, we also know...

Bookkeeping: Artificial Intelligence and Importing Transactions

Let’s face it we all want faster, better and more efficient results. Especially when it comes to...

Tips to Avoid Making Costly Bookkeeping Mistakes

The Most Common (& Expensive) Bookkeeping Mistakes:Incorrect Payroll Reporting: If you...

Accountants Access: Connecting Your CPA and Your Financial Accounts

As part of the client accounting services we provide, Senter CPA requests access to certain bank...

Senter CPA: 8 Frequently Asked Questions

As tax and accounting professionals in the financial industry, we here at Senter CPA recieve lots...

Welcome to the Senter, CPA Team – Michelle D. Hare

My name is Michelle Hare, I am the newest member of the team at Senter, CPA. I am excited to be...

Tax Planning: What It Is & Why You Should Be Doing It

Tax planning is the process of managing your financial plan with the goal of reducing your tax...

Do You Have a Senter, CPA Client Portal? Try These 5 Pro Tips!

The client service experience is a fundamental core value at Senter CPA as our firm strives to...

Senter CPA Staff Picks: Best Books for Professional Development

Professional development is necessary no matter the stage of your career. Often times,...

Client Accounting Services

What are Client Accounting Services? Our client accounting services (CAS) focuses on our clients,...

7 Red Flags That Could Trigger an IRS Audit

An IRS audit takes place when the Internal Revenue Service (IRS) chooses to investigate a taxpayer...

Why I Chose To Be An Accountant In Clarkston, Michigan

The reason I chose to become an accountant in Clarkson, Michigan was due to my family, which...

Hiring: Staff Accountant (Hired 08/03/2020)

OUR FIRM We are a full-service CPA firm providing tax, accounting and consulting services in...

Three Quarterly Conversations to Have with Your CPA

The importance of establishing a strong working relationship with your CPA is crucial to feel...

How to Make Your Upcoming Estimated Tax Payments

Unsure how to make your upcoming estimated tax payment? Here's how. Most folks don't like to pay...

Senter, CPA – Firm Update

As restrictions lift and businesses prepare to reopen doors, our team has taken time to reflect,...

Certified Public Accountant’s are Making a Real Difference Right Now

Business owners and other industry professionals are adapting and adjusting to the new normal, as...

Set Yourself Up for Success: Tracking Business Expenses

I'd be willing to bet that most small business owners don't wake everyday excited and ready to...

Spring Clean Your Finances in 8 Simple Steps

Spring is a time of new beginnings and fresh starts. While your finances don't start over, they do...

Embracing Change: Virtual Accounting Services

Collaboration with your accountant or other industry professional may seem like a daunting task....

Senter, CPA: A Virtual Firm

Thinking about how to work with your accountant remotely? Senter, CPA was a virtual firm long...

Together, Apart: Connectivity During Quarantine

Currently, more than 90% of Americans are observing stay-at-home orders due to the Coronavirus...

COVID-19 Relief: What You Should Do Next

We understand you have been impacted by the novel Coronavirus (COVID-19) and we are here to help....

Working from Home: Ten Tips on Productivity

At one point or another in our careers, we've all found ourselves needing to work remote. For some...

Understanding the 2019 IRS Extension

Due to the COVID-19 outbreak and consistent with our expectations, the IRS released their notice...

Special Edition: Update Regarding COVID-19

To Our Existing and Prospective Clients: The safety and well-being of our valued clients and...

Income Tax Refund: The Do’s and The Don’ts

Are you expecting, or perhaps already received, an income tax refund from your 2019 filing? If so,...

Certified Public Accountant: Why You Need One in 2020

What does financial success mean to you? Security, peace of mind or perhaps more free time spent...

Tax Credits: Take Them All

With tax season in full swing you are probably starting to work on your personal return or getting...

2020 Tax Season: It Begins Today

Tax season officially starts today with the Internal Revenue Service (IRS) now accepting e-files...

Workplace Dependent Care Benefits

If you have paid for the care of your dependent(s) in the past and anticipate that dependent care...

Welcome to the Senter, CPA Team – Kylie N. Harig

Hi there! My name is Kylie Harig and I am the new office manager at Senter, CPA. I am so thankful...

2019 Our Year in Review

What a Year it’s Been! 2019 has been an incredible year for the entire Senter crew; it's been...

Comprehensive Financial Planning: Building a Dream Team of Professionals

Building a network of well-connected financial professionals is a crucial means of personal wealth...

IRS Penalties: Abatement & Resolution

Have you ever paid an IRS penalty or feel like you've accumulated too many penalty notices from...

5 Things to Put on Your Year End Checklist

It's important to keep a checklist of items on your financial radar as we approach the close of...

Foreign Bank and Financial Accounts: Understanding the FBAR

Did you know that a taxpayer must report certain foreign financial accounts, such as bank...

Tax Scams: Be Careful, They Exist

As year-end approaches, we want to remind our friends and clients of potential tax scams that...

Clarkston Area Chamber of Commerce: The 2019 Young Professional of the Year Award

The Clarkston Area Chamber of Commerce honors individuals and organizations each year for their...

Ask a CPA: FREE Individual Tax Planning Course

Ever wondered if you could reduce your tax liability or pay less tax on your income? Come join us...

Clarkston Rotary Annual Beer, Wine, Spirits and Food Tasting: 2019

Place: Bordine's of Clarkston - 8600 Dixie Hwy, Village of Clarkston, MI 48348 Date: October 24,...

Hiring: Office Manager (Hired 11/13/19)

OUR FIRM We are a full-service CPA firm providing tax, accounting and consulting services in...

IRS Withholding Estimator: Time for a checkup

The IRS has released a new Tax Withholding Estimator and is encouraging everyone to perform a...

Support Agreements: Software

Consider the scenario: You’ve just purchased QuickBooks and the salesperson asks if you’d like to...

Like-kind Exchanges: Tax Deferred Gains

Like-kind exchanges are most popularly thought of exchanges of real estate under current law....

Investing in Data Protection

One of the most valuable investments you can make as a business owner is to invest in data...

Bank Reconciliations

Reconciling your bank account is a simple yet often overlooked part of one’s accounting system....

Freelancing and Taxes: Plan for them

Freelancer is a term we see a lot these days and the tax implications are different than as an...

2019 Youth Baseball Opening Day: Independence Township

2019 Youth Baseball Opening Day: Independence Township Parks, Recreation & Seniors. As big...

Matthew Senter, CPA: Introduction

Welcome to our blog! Our goal with this blog is to keep our friends and clients informed about us,...